City of Longview could raise property taxes to fund employee raises

Published 10:00 pm Sunday, July 20, 2025

People. People who patrol the streets. People who put out the fires and take people to the hospital after a bad wreck. People who fix broken playground equipment or run the Broughton Recreation Center.

It’s those city of Longview employees, and all the others, who are behind a proposal to raise the tax rate 2.3 cents as part of the 2025-26 budget to 58.49 cents per $100 valuation. That would mean a property owner would pay $51.36 more a year for a residence valued at $223,000, which is the average home value in Longview.

The increase would provide across-the-board salary raises for city employees of 6% plus $1,000.

Trending

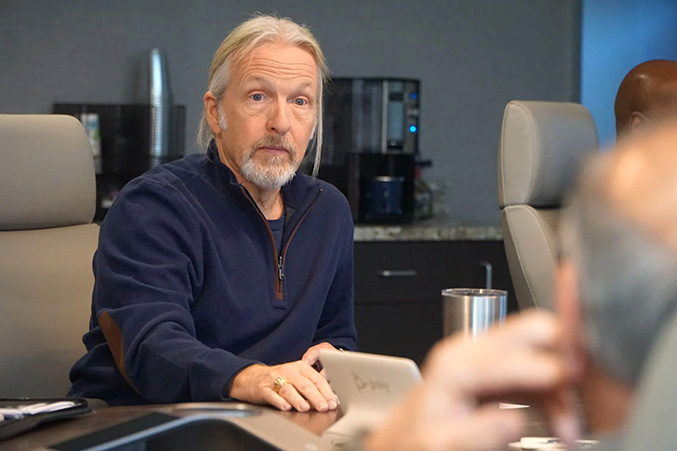

“Last year (this) was a heard-and-reheard topic that we needed to do something for employees,” said City Manager Rolin McPhee. “Again, this is identified as the top priority in the budget proposal. And the other thing is, how do we … provide pay adjustments that are sustainable, because obviously those are costs you can’t just walk away from. You’ve got to be able to maintain your revenue to do those things.”

The services that city government provides touches everyone in the community, he said. He encouraged people to think about the budget in terms of those services

“We are the government that actually touches everyone in this community,” compared with federal and state governments, McPhee said.

He presented the budget proposal to the City Council during a meeting this past week. It shows spending would barely change, with a proposed lower 2025-26 general fund budget of $100.6 million compared with $101.4 million in the current budget year. The general fund is where spending for things such as police, fire, streets and the library is accounted for.

The total city budget, which includes paying for debt, and enterprise funds such as water and sanitation would be close to the same from year to year, $224.3 million in the proposed budget and $224.4 million in the 2024-25 budget.

No action was planned for the meeting, and budget discussions will continue July 24, Aug. 5 and Aug. 14. The Aug. 5 meeting will include a preliminary vote on the proposed tax rate.

Trending

Public hearings are planned Aug. 21 for proposed fees, the 2025-26 budget and proposed tax rate and, if necessary, a tax increase. A vote on the actual tax rate is set for Aug. 22.

McPhee previously said the proposed pay increases would not get employees to their market pay rates.

“It’s always been the council’s idea to be within 95% of the market pay, but this will keep it within at least 10% of that market pay plan,” he said.

Mayor Kristen Ishihara said this past week that she believes the raises McPhee proposed are the “minimum we should do.”

“I would love to do more,” she said, also saying she supports the proposed tax rate increase to provide those raises.

City staff did make earlier cuts in city expenses before the budget was presented to the council

Water and sanitation rates are proposed to increase as well.

Monthly residential trash rates are proposed to increase 5.4%, from $18.35 to $19.36. And basic commercial sanitation rates are proposed to increase 5.5%, from $32.56 to $34.35.

Water rates are proposed to grow because of increased labor costs associated with the raises, but also because of increased costs for raw water purchases and higher maintenance and chemical costs.

A typical residential water customer’s monthly bill, for 6,000 gallons of water, would grow 1.5% from $51.08 to $51.85. The wastewater rates that are part of that bill would not increase.